More strange puzzling numbers coming out of life insurance

Deaths per capita are usually tightly predictable, but it appears something serious is going on in terms of unexplained excess deaths in people aged from 18 to 64. These are people in the prime-of-their lives. If Departments of Heath and Professors of Medicine were working for taxpayers, we surely wouldn’t be trying to guesstimate how many people have died from looking at insurance company payments. But here we are. Someone official has all the morbidity and mortality data. Someone knows.

In January we heard that the chief of OneAmerica Life Insurance was astonished that there was an “unheard” of rise in deaths in working adults of ages 18 – 64 in the last two quarters of 2021. Deaths in this working age group were up by an amazing 40% above the historical norms.

“We are seeing, right now, the highest death rates we have seen in the history of this business – not just at OneAmerica,” the company’s CEO Scott Davison said during an online news conference… “The data is consistent across every player in that business.”

“Just to give you an idea of how bad that is, a three-sigma or a one-in-200-year catastrophe would be 10% increase over pre-pandemic,” he said. “So 40% is just unheard of.”

These extra deaths did not seem to be from people who died of Covid but were untested. It was unlikely they were unrecognised Covid cases. Official case counts of Covid were lower than the year before, and test positivity was down too. The timing of the mysterious excess deaths fitted better with a widespread experimental medical program that was rolled out en masse in the last two quarters of 2021.

There has been little news since then, which is probably not surprising given the high stakes, intense media un-interest, and also that it’s probably not something the insurance companies want to share widely, since it could affect earnings. Which is exactly the next point. If there was a sudden rise in excess deaths we would expect to see it in insurance companies financial reporting. Which appears to be happening in reporting from Lincoln National — the fifth largest life insurance company in America. Indeed their numbers may be worse than the ones discussed in January.

Crossroads report by Margaret Menge

Fifth largest life insurance company in the US paid out 163% more in death benefits

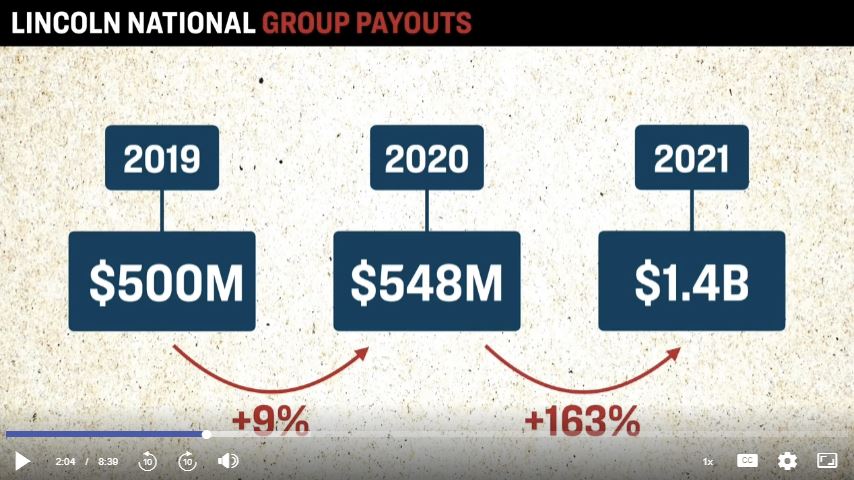

Lincoln National, reported a 163% increase in death benefits paid out under its group life insurance policies in 2021.

This is according to the annual statements filed with state insurance departments — statements that were provided exclusively to Crossroads Report in response to public records requests.

The annual statements for Lincoln National Life Insurance Company show that the company paid out in death benefits under group life insurance polices a little over $500 million in 2019, about $548 million in 2020, and a stunning $1.4 billion in 2021.

It’s not clear how many extra deaths there were, this is just the payouts. Crossroads do some average estimates of normal payouts of around one year’s salary and guesstimate that Lincoln National paid out for around 20,000 deaths in the 18 -64 age group, which is about twice as many deaths as normal.

There have been a million deaths ascribed to Covid in the US during the pandemic and there are normally three million deaths a year, so these numbers may not look that large, but if healthy working age people are dying 30% more often or 100% more often, then something dreadful is going on.

Payouts for individual life policies were up 30%

The statements for the three years also show a sizable increase in ordinary death benefits — those not paid out under group policies, but under individual life insurance policies.

In 2019, the baseline year, that number was $3.7 billion. In 2020, the year of the Covid-19 pandemic, it went up to $4 billion, but in 2021, the year in which the vaccine was administered to almost 260 million Americans, it went up to $5.3 billion.

Increases show up in other company reports but may not be as bad as Lincoln.

Annual statements for other insurance companies are still being compiled and reviewed. So far, Lincoln National shows the sharpest increases in death benefits paid out in 2021, though Prudential and Northwestern Mutual also show significant increases — increases much larger in 2021 than in 2020, indicating that the cure was worse than the disease — much worse.

Shares in Lincoln National are down 3.6% in the month since the earnings report was released.

h/t David Archibald

The SEC has a copy of the May 4th Press Release.

SEC Lincoln National Financial Group First Quarter 2022 Results

Group Protection

Group Protection reported a loss from operations of $41 million in the quarter compared to a loss from operations of $26 million in the prior-year quarter. This change was driven by non-pandemic-related morbidity, including unusual claims adjustments, and less favorable returns within the company’s alternative investment portfolio.

The total loss ratio was 88% in the current quarter compared to 87% in the prior-year quarter, with the increase driven by unfavorable non-pandemic-related morbidity and unusual claims adjustments.

Group Protection sales increased 42% to $105 million in the quarter compared to the prior-year quarter. Employee-paid sales represented 57% of total sales. Insurance premiums of $1.2 billion in the quarter were up 4% compared to the prior-year quarter.

Life Insurance

Life Insurance reported income from operations of $58 million compared to $107 million in the prior-year quarter as improved pandemic-related mortality was more than offset by less favorable returns within the company’s alternative investment portfolio and less favorable underlying mortality.