John Hussman warns that people may not realize how much stocks are likely to crash

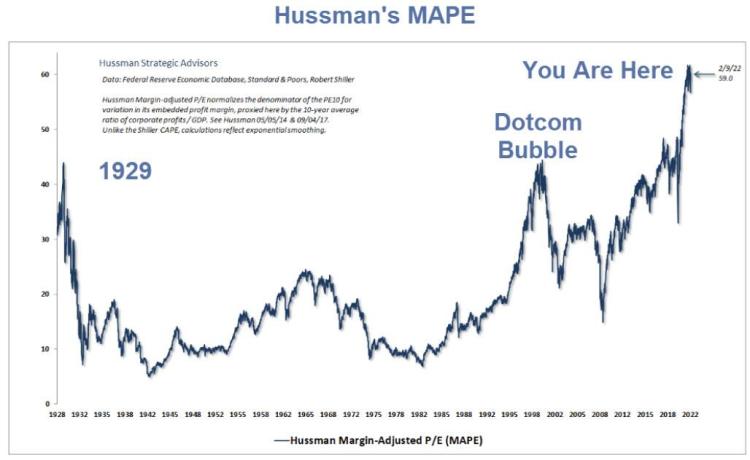

Dr David Evans supplied some interesting links and adds “The biggest theme in markets is that ratios eventually revert to their mean (or average). No, it’s not different this time. A return to average on this graph implies a drop of about 75%.”

Hassman Margin-Adjusted P/E (US stock market price-earning ratio (adjusted))

John Hussman: Investors are paying top dollar for top dollar

Why is it so hard to accept that speculative bubbles can burst? Interest rates were driven to zero for a decade. Yield-starved investors chased stocks to valuations beyond the 1929 and 2000 extremes. That speculation front-loaded more than a decade of future market gains into the present. Those gains are now behind us, embedded in breathtaking multiples. If history is any guide, a collapse in valuations is likely to return those gains to the future.

The process of losing speculative gains and recovering them over time is what I’ve often called a “long, interesting trip to nowhere.” It bears repeating that the S&P 500 lagged Treasury bills from 1929-1947, 1966-1985, and 2000-2013. 50 years out of an 84-year period.

Now, it’s not impossible to “grow your way out” of extreme valuations, but the arithmetic can be daunting. For example, given that our most reliable valuation measures are about 3.6 times their historical norms, consider this. Even if these valuation measures were simply to touch their historical norms 30 years from today, prices would have to grow about 4% slower than fundamentals for that entire period (1/3.6 ^ 1/30 – 1 = -0.0418). When you realize that S&P 500 revenues, nonfinancial gross value-added, and nominal GDP have all grown at a rate of only about 4% over the past 10, 20, and 30 years, that 4% valuation headwind would combine to leave the S&P 500 unchanged over those 30 years.

Mish Shedlock: Most People Have No Idea How Much Stocks are Likely to Crash

Is there any escape? In aggregate no. For every seller there is a buyer. In this case a buy-the-dipper. Someone must hold every stock every step of the way down, and pension funds will do just that.

Individually, investors have a choice. You can cash out, lighten up, or try to buy value. … But most won’t. It is extremely difficult to believe what … Hussman is saying, and what I am saying. …

The upcoming decline will shock most bears. Many will buy the dip, then that dip and then the next dip. Some hedge funds will do this with leverage and blow up.

If you just retired and think you have a big next egg and can ride it out in equities, expect your portfolio to fall by 50%, minimum.

If you are age 24 with few assets, you should be rooting for an epic decline. …

For sure, the Fed will “try” to halt the decline. And so will Congress by sloshing money everywhere.

The beneficiary of fiscal and Fed stimulus is highly likely to be gold.

Faith in the Fed is a key driver for gold. And it blew the third major bubble in just over 20 years.

The Fed has no credibility and that should already be obvious. Soon it will be unavoidably obvious.

David Evans also often points out that gold is the currency that competes against the central bankers: “It’s an anti-cheating device”. It’s a rare currency that government can’t print from nothing, and ease into quantitative oblivion.

Though Big Bankers have other tools, such as shorts on a paper-gold market, which discourage punters from running away from fiat dollars into other stores of wealth, like precious metals. And surprise, just as War breaks out, uncertainty goes through the roof and for some reason the price of gold falls $100. None of which make sense but works out well for the Big Bankers. Conveniently.

Dr David Evans: Jo’s other half, mathematician and founder of GoldNerds.